Everything you need to know about auto insurance in the US

What car insurance to take and what determines its value? Photo: depositphotos.com

Having a car in the US is not a luxury, but a necessity, especially in small cities, where public transport is much worse developed than in big cities. ForumDaily previously told how to buy a car in the states. However, at the same time as the car, it is necessary to purchase an auto insurance policy. What kind of car insurance to take, and what determines its cost? ForumDaily prepared answers.

Price issue

Marat Kamenev has been living in California with his wife for 2 years. The family has 2 cars - a 4 Toyota RAV2014 and a 1999 Toyota Corolla.

When applying for insurance, the driving experience and age of the driver are very important. At the time when Marat and his wife bought an insurance policy, they were 33 and 34 years old, respectively. Marat had 10 years of driving experience, his wife - 6. The guys live in a calm and safe area, which does not increase the cost of insurance.

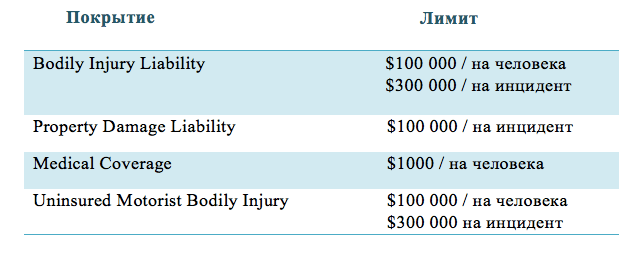

Both vehicles are insured by Farmers. The couple pays for insurance $ 141 per month ($ 846 for six months). Limits on car insurance can be seen in the table below:

An example of California insurance policy limits

Last year, when returning from a holiday on Lake Tahoe, a stone was hit in the windshield of Marat's car, as a result of which the windshield had to be replaced. Marat appealed to the insurance company, reporting the incident. The glass was replaced within a couple of days, from his own pocket Marat paid $ 100, as his insurance was with a deductible. The incident did not affect the further cost of insurance.

In general, the following factors affect the cost of auto insurance:

— gender and age of the car owner;

- his marital status;

— driving experience in the USA (worldwide);

— the area in which your vehicle will remain overnight;

— insurance limits;

- franchise (deductible). It reduces the cost of car insurance if you decide that in the event of an emergency you will partially pay for the damage yourself. For example, if you decide that your deductible is $500, then in the event of an accident that causes you $3000 in damages, you will only be reimbursed $2500; you must pay the remaining $500. And if you scratch your bumper while parking and the repair ends up costing $300, you don’t need to contact the insurance company. That is, the deductible essentially reduces the total cost of the insurance policy, and the higher it is, the lower the cost of insurance.

Ruben Alishaev has lived in the USA for 14 years. Now - in the state of New York in the safe “Russian” district of Queens Rego Park. Ruben has a 60 Infiniti QX2016 leased. The car insurance includes 2 drivers - Ruben himself and his dad Joseph. The drivers' ages are 31 and 65, respectively, and their driving experience is 13 and 12 years. The main driver is Ruben, the second is his father, although in fact this is his father's car.

But for an insurance company, Ruben looks like a more reliable driver, because he has the best credit history and, unlike dad, there are no penalty points for driving. Insurance of this vehicle costs Ruben about $ 2000 per year. The car is insured in the company Geico.

In general, in New York, insurance is more expensive than, for example, in California. But at the same time, a driver who lives in a village in upstate New York will pay less than a resident of Los Angeles or San Francisco.

For example, 36-year-old Alisa Savelyeva from the city of Galloway in New Jersey, together with her spouse own Mercedes Benz C230 2006 of the year and Toyota 4Runner 2016 of the year.

Each car has insurance, at the time of registration of which the drivers had driving experience 12 and 6 years, respectively. For both cars insured by Geiko, the couple pays $ 981 for six months.

In addition, even the results of the insurance company's own financial activities may affect the cost of insurance. So, if she had significant losses in the previous year, then she had to just, for no other reason, raise the prices of insurance in order to stay afloat.

In New York, insurance is more expensive than, for example, in California. Photo: depositphotos.com

The difference in approaches

The issue of auto insurance in the United States is complicated by the fact that the country does not have a federal system regulating this industry. Each state is independently engaged in the formation of requirements for car insurance.

However, in this regard, all states can be divided into 2 categories:

- Regardless of who is at fault, the damage caused to you is covered by your insurance (no fault). This type of insurance is common in 12 states - Florida, New York, Michigan and others.

- Responsibility falls on the cause of the accident (in English this is called at fault). So work in 38 states, including, in California and Washington.

You can buy car insurance in person or online at an insurance company, from an insurance agent or broker (the latter must have a license). Insurance is valid for 6 or 12 months. It can be paid monthly, but it can be a single amount, for which they often give a discount. With annual insurance the price is guaranteed not to rise, with 6-month policies can raise the price every six months.

Often, insurance companies offer very favorable conditions for new customers. However, in good insurance companies there are also discounts that are offered to regular customers with long-term cooperation.

What you need for car insurance

When applying for insurance, you will be asked to provide the following documents and data:

- American driver's license (if you don't have one, the license you have). Just because you don't have a local driver's license doesn't mean you can't be insured. Most likely, insurance will be slightly more expensive than if you had a local license. The main thing is not to forget to inform your insurance broker about their receipt;

- VIN (vehicle identification number);

- Make, model and year of release;

- The zip code of the place where your vehicle will stay overnight. Each insurance company has its own safe area rating. Accordingly, the more incidents happen where you live, the more expensive your insurance will cost you.

There is also one more item that must be indicated for insurance - the estimated number of miles you plan to drive per year. These data are provided in the form of letters in free form. Some insurance companies ask each year to submit papers reflecting the real state of things. And if suddenly it turns out that you greatly underestimate the data, then you may be required to compensate for the last 3 of the year. In general, it should be borne in mind that any fraud with automobile insurance is a federal crime and is punished accordingly.

What does insurance consist of?

A car insurance policy is a set of different types of coverage. There are many in the auto insurance industry. Let's consider some of them.

Liability Coverage - Mandatory civil liability. The most important coverage, especially for such states, where all responsibility falls on the perpetrator of the accident.

It should be borne in mind that if in the event of an accident with serious car damage the insurance of the person responsible for the accident does not cover all expenses, the remaining amount will be demanded from the court. And on account of its coverage will go all bank accounts of the family, the property owned, shares, if any, as well as the amount of 25% of the money earned by all family members in the next 10 years.

That is why, when insuring a car, you should imagine the worst and insure yourself enough to be sure that tomorrow they will not take everything away from you.

Insurance broker and lawyer Diana Mozatyat tells an incredible story about what surprises drivers can expect on the road.

“A married couple went on a trip to Ohio. We were traveling in a “home on wheels”. One day their tire got punctured, but they only noticed it when sparks were already starting from the contact of the wheel rim and the asphalt,” she says. — As a result, the field located next to the highway caught fire from a spark. The damage was estimated at $3 million. $300 thousand was covered by their insurance, and they had to pay the rest out of their own pocket.”

Medical Coverage / Personal Injury Protection (medical coverage) - it is mandatory in some states, such as New York and Florida, and completely optional, for example, in California.

But those who live in states where this coverage is not necessary should think about including it in the insurance, because these funds are issued instantly, regardless of who is to blame for the incident. Moreover, a good insurance broker will certainly advise you to arrange such coverage, because with its help you will be protected in case of injury. While the trial is underway, who is right, who is wrong, you need to get medical assistance - and you can take money from this coverage from this.

And here are 2 more types of coverage that are worth including in your insurance policy - they will provide protection in the event that you collide on the road with a person who does not have insurance or who has insufficient insurance.

Uninsured Motorist Bodily Injury / Underinsured Motorist Bodily Injury - this covering is responsible for the injuries and moral damage caused, and Uninsured Motorist Property Damage covers damage from vehicle damage.

Since the cost of a policy is influenced by many factors, the most correct decision in the issue of obtaining insurance is to find a professional broker who will help you choose exactly the policy you need.

To minimize risks, you should contact only licensed insurance agents or large insurance companies. Don't be fooled by low car insurance prices, as they often mean immediate gains and a possible big loss if something bad happens on the road.

See also:

How to get a credit card and build a good credit history

Subscribe to ForumDaily on Google NewsDo you want more important and interesting news about life in the USA and immigration to America? — support us donate! Also subscribe to our page Facebook. Select the “Priority in display” option and read us first. Also, don't forget to subscribe to our РєР ° РЅР ° Р »РІ Telegram and Instagram- there is a lot of interesting things there. And join thousands of readers ForumDaily New York — there you will find a lot of interesting and positive information about life in the metropolis.